As the holiday season approaches and the 118th Congress comes to a close, ACTION reflects on achievements over the last two years. While the legislative environment prevented the enactment of the Affordable Housing Credit Improvement Act, we built the strongest foundation the Housing Credit has ever had in terms of bipartisan support, leaving us in an especially strong position going into what is expected to be one of the most important years for tax action in decades. Tax policy is a marathon, not a sprint, and we should be proud that we have achieved so much:

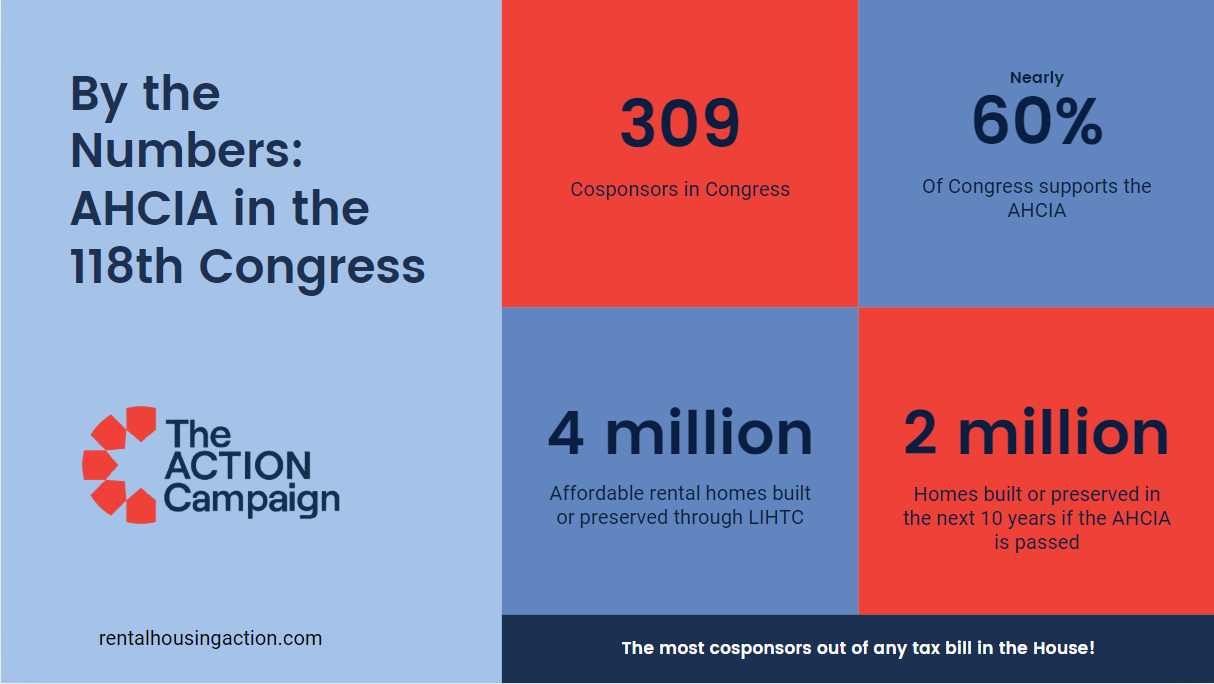

274 House and 35 Senate cosponsors. That’s the highest level of support for the bill since it was first introduced in both chambers in 2016. To put that in context, the bill is supported by nearly 60% of all members of Congress. The bill also had more Republican support than it has ever had in previous congresses.

Strong support from congressional tax-writers. Members of the Senate Finance and House Ways and Means committees play a critical role in shaping tax policy. In the 118th Congress, 61 percent of the Senate Finance members and 80 percent of House Ways and Means members cosponsored the legislation.

Support across the political spectrum and from leadership. AHCIA cosponsors span the ideological gamut, from progressives to the Freedom Caucus. Moreover, 44 Committee chairs and members of the House and Senate leadership teams have signed on.

More cosponsors than any other House tax bill. H.R. 3238—the House version of the legislation—has 50 more cosponsors than the next most sponsored tax bill.

House passage of the biggest increase in the Housing Credit in decades. While we did not overcome the final hurdle in the Senate, don’t forget that in the 118th Congress we saw House passage of a major increase in 9 percent Credit authority and a lower bond financing test.

We also want to acknowledge the support of members of Congress who are not reflected in the official cosponsor count.

There are 24 Democratic senators who sought to cosponsor the AHCIA but are not included in the numbers above because of the strategic goal of maintaining approximate party balance. We would like to recognize these senators for their support of affordable rental housing in the 118th Congress and their continued support in the next year.

The current list of senators who support the AHCIA, but do not appear officially on Congress.gov, includes:

- Tammy Baldwin (D-WI)

- Richard Blumenthal (D-CT)

- Cory Booker (D-NJ)

- Chris Coons (D-DE)

- Dick Durbin (D-IL)

- John Fetterman (D-PA)

- Kirsten Gillibrand (D-NY)

- John Hickenlooper (D-CO)

- Mazie Hirono (D-HI)

- Tim Kaine (D-VA)

- Amy Klobuchar (D-MN)

- Ben Ray Luján (D-NM)

- Ed Markey (D-MA)

- Jeff Merkley (D-OR)

- Patty Murray (D-WA)

- Jon Ossoff (D-GA)

- Gary Peters (D-MI)

- Jack Reed (D-RI)

- Brian Schatz (D-HI)

- Jeanne Shaheen (D-NH)

- Kyrsten Sinema (I-NM)

- Tina Smith (D-MN)

- Chris Van Hollen (D-MD)

- Peter Welch (D-VT)

The massive popularity of the Housing Credit shows how important it is to keep advocating for the AHCIA. The 119th Congress, which will convene next month, has been called the super bowl of tax, as many of the provisions of the Tax Cuts and Jobs Act of 2017 are expiring at the end of 2025.With affordable housing a top priority nationwide, Members of Congress should be encouraged to continue fighting for Housing Credit provisions in the tax package next year.

Please take the time this holiday season to write a thank-you letter to your members of Congress if they are AHCIA cosponsors or in the queue. You can use our thank-you letter template as a guide. Even if your Member of Congress is retiring soon, they still hold sway with other Members of Congress and staff, so be sure to urge them to keep supporting the Housing Credit as well.

Thank you template for Members of Congress:

Dear [Member of Congress]:

Thank you very much for supporting the Affordable Housing Credit Improvement Act (AHCIA) in the 118th Congress. Your work to fight for affordable rental housing is appreciated by millions of workers and families who deserve a stable place to call home. The Low-Income Housing Tax Credit (Housing Credit) remains the most effective way to encourage private investment in the development and preservation of affordable housing, and we appreciate your efforts to make it even stronger. Passing the AHCIA in the next Congress would finance almost 2 million additional affordable homes in the next decade, support nearly 3 million jobs, and raise $115 billion in additional tax revenue and $333 billion in wages and business income.

We encourage your continued support for the AHCIA: please check out our National, State, and District fact sheets to see the impact of the Housing Credit across your state or district. It is crucial to continue advocating for affordable housing as Congress considers a new tax package in 2025. Thank you again for all your support, and we look forward to seeing your continued support next year.